Mortgage rates have started to subside.

This week we scored a 5.875% interest rate for my client.

Not only that, but we came up with a creative approach to lower my clients’ monthly payments by $691/month in the first year.

That’s right - $691/month…That’s a lot of money!

How did we do it? It’s called a 2 to 1 buydown.

These cost about 2% of your loan, but they drop your interest rate by 2% in the first year of the loan and 1% in the second year.

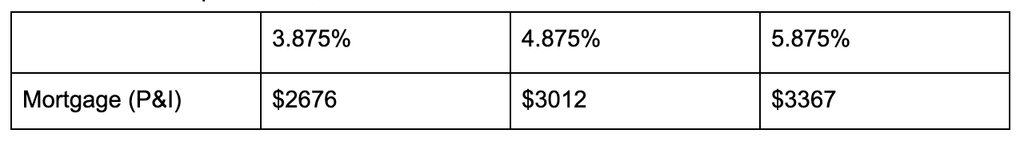

So, 3.875% in year 1, 4.875% in year 2, and 5.875% in year 3.

Are 2/1 buydowns worth it?

Let’s use an example of $632,500 home with 10% down:

Now in this client's case, I negotiated for the seller to pay for the buydown. At 2%, it came out to $12,500.

This raised the sales price, but it’s not rolled into the loan. So now my client saves $12,500 over two years in mortgage payments.

My client could have taken that money and applied it to a lower sales price, which would have changed the price from $632,500 to $620,000. This would have saved an extra $12,000 in interest over 30 years.

My client chose the buydown because they are monthly payment driven and wanted to save the $12,000+ dollars now, versus later.

I really enjoy helping my clients learn about creative ways to make their money go further, and I’d love to do this for you too.

If you want to chat about some options, give me a call or reply to this email.